Great Expectations – Our hopes for the MDBs at the Finance in Common Summit

September marks two months until the Finance in Common Summit - the first ever meeting of all 450 public development banks. Development banks that hold $11.2 trillion in public assets. With huge amounts of public money being spent as a result of the COVID-19 crisis, decisions made now, including during the summit, about how to use these funds must include the acceleration of a sustainable, just recovery.

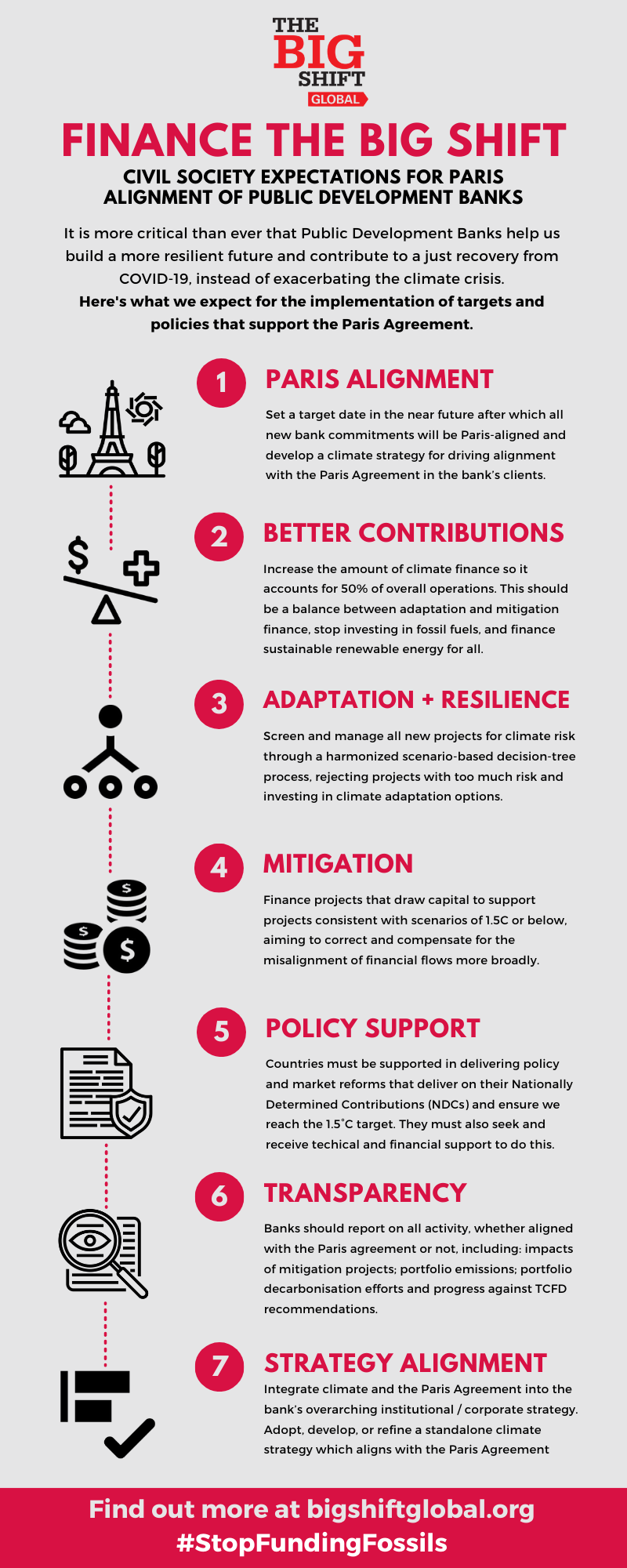

Public finance has a responsibility to show leadership and ambition for a just recovery and to lead the shift out of fossil fuel investments and into sustainable, renewable energy ensuring energy access for all. The Big Shift Global coalition wants to see ambitious outcomes from the multilateral development banks (MDBs) and other public development banks at Finance in Common. There should be no further investment in fossil fuels as part of a just recovery that also promotes social, gender and racial justice, the fight against inequalities, community care, people’s health and well-being, human rights and workers’ rights.

The multilateral development banks must use the opportunity of Finance in Common to announce clear progress on their joint approach to Paris-alignment and in particular ending direct and indirect support for coal, oil, and gas.

The announcement from the MDBs at COP25 in Madrid was disappointing and it is important they demonstrate concrete advances in their plans for Paris-alignment. This includes an end to investment in fossil fuels, the scaling up of investments in renewable energy, and the expansion of finance for energy access via distributed renewable electricity and clean cooking to reduce air pollution and health problems. These efforts must be embedded in a much wider ‘just recovery’ from the COVID-19 crisis, that can serve as a bridge to a ‘just transition’ that facilitates a zero-carbon future, more generally.

Along with other civil society organisations the Big Shift Coalition has laid out our expectations of Paris-alignment which includes commitments by the banks to:

- Designate a date in the near future by which all bank actions are Paris-aligned

- Provide climate finance that amounts to at least 50% of operations and specifically promote renewables and clean energy access for all

- Screen new projects for climate risk and discard those deemed too risky

- Finance projects consistent with scenarios that remain below 1.5C

- Provide technical and financial support to countries to deliver on 1.5C

- Ensure transparency on all activities linked to Paris-alignment (projects, emissions, decarbonisation actions)

- Adopt an overarching climate strategy for the bank which ensures Paris-alignment

It is more critical than ever that public money is being used to increase resilience and not to exacerbate the climate crisis. As Sonia Dunlop of E3G, a member of Big Shift, highlights a good outcome from Finance in Common should include ‘A commitment from all public development banks to deliver the Paris Agreement, the Sustainable Development Goals and the Convention on Biodiversity’ and ‘A Commitment to no longer use public taxpayer money to finance fossil fuel projects’.